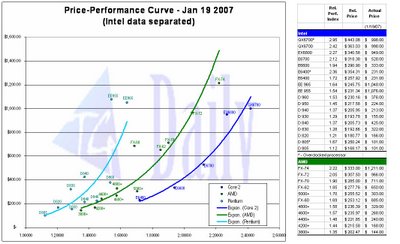

Thanks to Tom's Hardware Guide for this magnificent updated graph:

This graphic has some controversy about the performance measurements, but for the most part, the trends are there. Yes, I have come to validate the notion that Core 2 Duos are quite simply superior to anything AMD produces, with the only possible exception of the entry level dual cores 3600+ X2 at 65nm which is "Energy Efficient" and the 3800+ X2 because they have better performance/(power*price).

In this graphic you can not completely see how bad the Pentium processors are, because their inefficient power consumption is not part of the performance data.

But in any case, you may see here that the only competitively priced AMD processor is the 5000+ X2, and that barely.

Although the gist of the article in which this graphic appears is that AMD is raising its prices, you can see that such initiative wouldn't fly much. Whoever has the money to buy products mentioned in this chart goes to sites like THG for guidance, and the community of benchmarkers pretty much agree with THG, furthermore, Core 2 Duos have positive rapport among customers.

Perhaps AMD is relenting in its insistence to win market share. We have seen this year how inelastic the demand for processors is, thus, there is simply more money to be made raising the prices, if the market share losses are moderate. Why would AMD do that? because it needs money, perhaps to compensate for the huge ATI losses that must be occurring now. If AMD keeps being optimistic about ATI they may say that right now it is more important to have better cash flows than to gain market share, so that the company may finance the projects that will enable better products to make another market share win charge.

Continuing with "AMD's long year", I said that "AMD is losing lots of revenue share between the ceiling that superior Intel products impose and over the quicksand created by millions upon millions of netbusteds" are being dumped, that is the sandwich that this graphic illustrates.

Inelastic: Let us suppose that you have a retail store and product X costs almost nothing to you. You obviously want to make the most money with X, either selling small numbers at a high price, large numbers at low price, or something in between. The answer depends on the demand elasticity of X. If you lower the price of X 1% and that stimulates demand to raise 1% then X would be said to have 1 of demand elasticity coefficient. If you lower X price 1% but see that demands increases 2%, then you would try to lower the price as much as possible because the increase in demand is overcompensated by what you are not receiving in price per unit. If you lower prices 2% but only see 1% inrease in demand, then X is called "inelastic". In this case, you win more money if you raise prices as much as you can. The problem with raising prices, naturally, is that your customers go to your competition. The market share shifting tells you how far you can go.

Saturday, January 20, 2007

The Sandwich

Posted by

Eddie

at

12:21 PM

![]()

![]()

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment